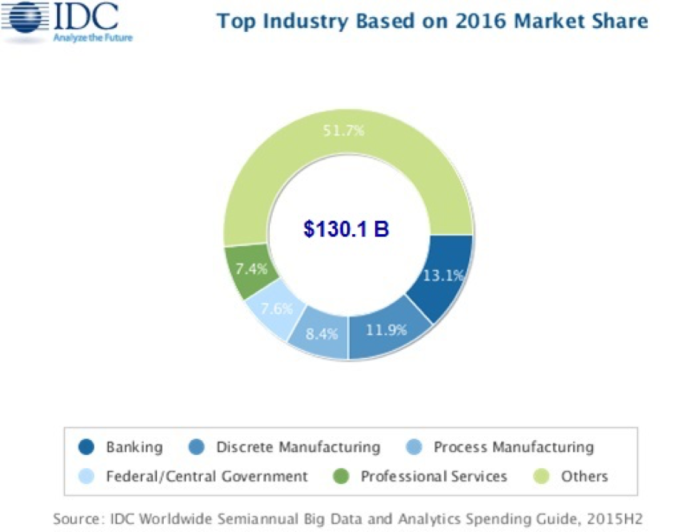

Above data shows that banking industry share along of Big Data and Analytics Spend will be 13.1% which will be roughly $17.5 B in 2016. Big Data and Analytics sales will reach $187 Billion by 2019. Market research firm IDC predicts that the revenue from big data applications and services will increase from $130 Billion in 2016 to more than $187 Billion in 2019. Service related opportunities will account for half of the revenue during 2016-19. After services, software will account for $50 Billion in sales in 2019. Nearly half of those software will be used for end-user query, reporting and analysis tools and data warehouse management tools according to IDC. Biggest organizations are going to be the big purchaser of the analytics solutions. Sales of these products to companies having more than 500 employees will generate $140 Billion in 2019. Source: IDC

Partnership between Banking and Fintech:

Instead of competing against each other, Banks want to leverage the new technologies developed by the Fintech. Banks can leverage agility, innovation and technology of startups and startups will get to operate their technology at much large scale and get experience in deploying their solution in banks

Improving the customer journey:

Banks and credit unions do not wish to wait to engage customer till they walk into their branch. Banks are looking at solutions which can engage customers at every stage of their purchase journey. Most of the customers are influenced by their experience during the journey and not just because of the offers given by the bank

Making Real time Decisions on Business Analytics:

Capturing consumer insight and using it to offer customized solution to customer will help bank in solidifying their relationship with customers. Consumer will expect the financial institutions to provide offer to them which are relevant to their profile.

Introduction of multi-channel delivery:

Today’s customer is present on multiple devices and multiple channels such as facebook, twitter etc. Customer expects the same level of experience as provided by amazon and other ecommerce retailers. To satisfy today’s hyper connected customer, banks need to customer on channels on which customer is present for sales and customer service.

Emergence of new breed of banks:

Competing with banks that have huge customers’ base, assts size, established systems and technology is tough for a fintech startup. However these banks were established long before the ATMs and mobile come into existence which makes it difficult for these established banks to adopt new infrastructure and technology. It is likely that new banks will appear in US, UK and globally.

Big data platforms will be integrated with conformance policies like data governance and compliance mandates.

Lots of banks are interested in building or buying systems that allow them to take credit decisions on loan in 5 minutes.

In real estate management, banks are using big data to analyze customer demographics against lease trending to position branches, kiosks and other service offices in key locations to maximize business

Non bank alternative lending are using big data for underwriting loans, banks are also going to join the bandwagon soon

Marketing is moving away from brand focused to more algorithmic, programmatic and context driven using data collection

Cybersecurity:

Criminals are finding ways to take money and data from banks and customers are becoming more vulnerable to online fraud and hacking. Cybercrimes are causing trillions of dollars loss to banks. Banks are looking for solutions that can analyze transaction data which can inform customer on any possibility of fraud. Banks are taking solutions which can inform them of a bank fraud as soon as it is reported across the country and bank can take preventive measures immediately.

Many banks are willing to work with big data software firms for things like data visualization and extraction. These projects not only require good understanding of the big data space but also how they interface with financial data. Banks are willing to spend time and resources where they find both ability to work with big data and financial data.

Banks are using tools which allow them to engage with community in a fun, personalized and educational manner. This gives them opportunity to provide tailored messaging to customers. They also want to use data to monitor social media conversations and online market trends.