Blockchain is an emerging technology that has been heavily betted on to revolutionize the way transactions are carried out today. The first blockchain was conceptualized by Satoshi Nakamoto in 2008 and implemented in the following year as a core component of the digital cryptocurrency currency bitcoin. Bitcoin serves as the public ledger for all transactions. The concept of blockchain made bitcoin the first digital currency to solve the double spending problem, without the use of a trusted authority or central server.

Blockchain in general can be used in any domain which involves transactions. Recently, Honduras government has put all land records in the country on a public ledger – the blockchain. Whenever there is a change in ownership, it gets recorded and available publicly. Some other domains in which blockchain is getting used are in thwarting diamond thieves and streamlining stock markets. In this article, we are going to focus on the impact of blockchain on the banking and finance sector.

What is Blockchain?

A blockchain is a public ledger of all transactions that have ever been executed. It can be thought of like a huge number of blocks that has been arranged in chronological fashion within a chain. The chain constantly keeps growing as new completed blocks are added to the chain.

Each node or computer within the network gets a copy of the blockchain. The blockchain has complete detailed information about transactions that has ever been created. Thus, every node in the network has access to all the information on the transactions that has taken place. It makes sure that there is no requirement of third parties like central bank or other intermediary for establishing trust and verifying transactions.

Advantages of Blockchain

Blockchain removes the dependence of the two parties directly involved in a transaction on some other centralized third party like banks, governments, credit card companies, etc. Some of the key advantages of Blockchain are:

- Speed: Today, an email can be sent over internet within a second but it takes several days for transferring money only because of these third parties involved in the process. This can be fast tracked if there is no necessity for these third parties.

- Economic: Not only does these third parties slow down the transaction process but they also take a significant portion of it as their fees.

- Security: If the records are centralized as is the case with the banks and governments, they can easily be hacked or manipulated. While if they are encrypted and decentralized across the network as is the case in Blockchain, it is not possible to do so.

- Transparency: The blockchain process is incredibly transparent and therefore being used by some of the governments for tasks like maintaining land records that are publicly available.

The interesting case of Bitcoins:

In 2008, an anonymous person or persons named Satoshi Nakamoto created a paper where he developed a protocol for a digital cash that used an underlying cryptocurrency called Bitcoin. And this cryptocurrency enabled people to establish trust and do transactions without the need of a third party. The underlying technology behind bitcoin is blockchain.

It is the blockchain that replaces this trusted third party in case of bitcoin. A database that contains the payment history of every bitcoin in circulation, the blockchain provides proof of who owns what at any given moment. This distributed ledger is replicated on thousands of computers which are called bitcoin’s nodes around the world and are publicly available. But even for all its openness it is also trustworthy and secure. At the interval of every 10 minutes, a new block is added to the blockchain. A case that frequently occur is that the records present with the nodes in the network are not all same. In this case, the settlement for decision on which one is the genuine set of records is taken on basis of solving a computationally expensive complex mathematical puzzle. This process is a sophisticated version of simple techniques like majority voting made to favor the majority. So, if one node corrupts the records and want to prove that the corrupted records are actually true, then it has to have the computational power to beat the combined computational power of all other nodes in the network which is not a practical possibility.

How is Blockchain impacting Banks?

Recently, there has been a major shift with big banks who hoping to adopt the blockchain technology to make their transactions cheaper, faster, efficient and reliable. Infact, IBM report titled “Leading the Pack in Blockchain Banking: Trailblazers Set the Pace.” Claimed that banking and financial markets are adopting the technology “dramatically faster than initially expected”.

IBM claims that within next four years 66% of banks are expected to have blockchain in commercial production implemented at scale. Eight major banks including HSBC and State Street has already successfully tested out blockchain in bond transactions earlier this year. While UBS and Santander have been trying out the technology for cross-border payments. Also, Bank of America announced a partnership with Microsoft to experiment with the system.

Blockchain in BFSI

The industry that is seeing the most buzz around blockchain is the Banking and Financial Services Sector. Because blockchain, the underlying technology of Bitcoin, can reduce inefficiencies and bottlenecks in a number of areas in traditional finance (i.e Stocks, Bonds, Commodities, etc.); organizations such as Goldman Sachs and JPMC have began to experiment with the technology in house or through strategic partnerships with Fintech Startups.

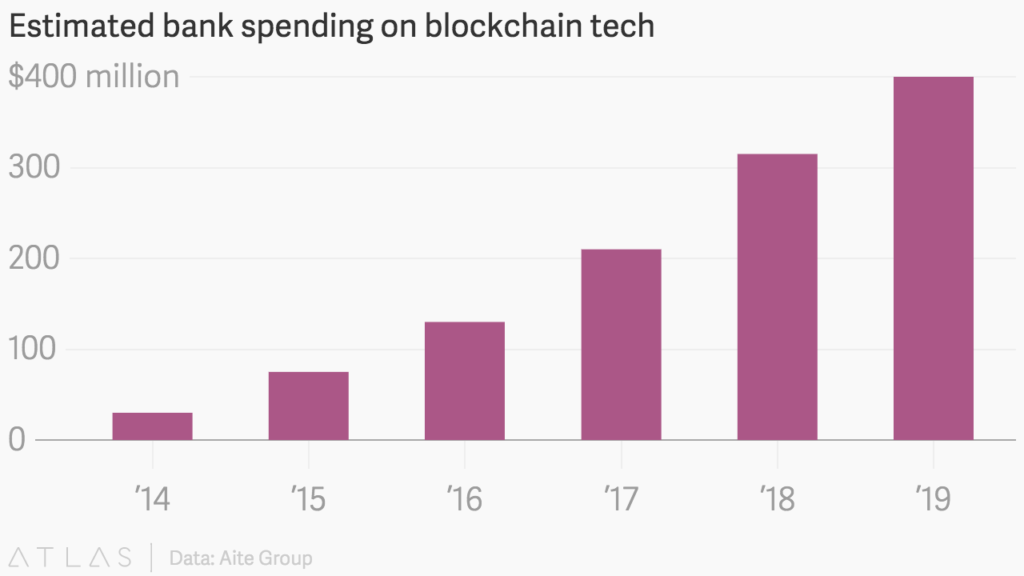

Source: Aite Group

Some notable fintech startups in the blockchain space include:

1. GemOS: Gem offers data storage solution on blockchain. It has built a platform that can connect multiple data storage points inside the organization and register them on a common ledger.

2. BigchainDB: It is an open source big data distributed database system storing data on blockchain and can issue any currency using this platform as it supports multiassets.

Blockchain in Payments

The Payments space, for example, is ripe for a blockchain led disruption. The technology has the capability to make payments cheaper, more secure, and faster. Additionally, with markets such as the EU which introduced the Payment Services Directive 2 (PSD2); it will open up doors for Banks to collaborate with Fintech Startups to innovate payment technology (such as real-time settlements) using the blockchain.

Historically, we’ve relied on 3rd party intermediaries such as banks to facilitate the settlement and act as custodian for the transaction. However, with the advent of bitcoin, the role of 3rd party intermediaries is completely removed except for verifying the credentials of the customer or user who conducts the transaction.

Some notable fintech startups in the blockchain space include:

1. SETL has received award for “Hottest startup in blockchain” in Europas award in June,2017. It was launched in July 2015 to deploy a multi-asset, multi-currency institutional payment and settlements infrastructure based on blockchain technology. Its system will be used by market including banks and asset management firms to move cash or assets directly between each other.

2. Cipherex Cipherex’s product mSIGNA™ is a multisignature wallet which supports best security practices and is among the most secure wallets rated by bitcoin.org. It works for both bitcoin and Litecoin.

3. GoCoin It provides simple API based integrations to accept payment in bitcoin for any company having online presence.

4. SafeCash Safe Cash technology powers banks, merchants and consumers. Using this product, you can instantly send and receive money and tokens worldwide. It can be used for cross border remittances, donations, recurring payments and other usecases.

“Payments are very ripe for a change and an improvement in terms of costs, quality of service, making the process more transparent and continuous” – Julio Faura, Banco Santander

Blockchain in Capital Markets

Another space which is ready for a blockchain disruption is stock trading. If you evaluate the current scenario of the stock market, it is easy to realize that equity trading is a complex world filled with non-binary processes and large costs.

A report by Oliver Wyman suggests, “IT and operations expenditure in capital markets is currently close to $100-150 billion per year among banks. On top of that, post-trade and securities servicing fees are in the region of $100 billion. Significant capital and liquidity costs are also incurred because of current delays and inefficiencies within market operations.”

The blockchain technology can help adopters by cutting the number of redundant processes, collateral requirements, operational overheads, and settlement time. Exchanges are such as the Nasdaq and Australian Stock Exchange are already ahead of the game in implementing blockchain.

Research carried out by Accenture and McHagan also claims an impressive 70% reduction of cost in Core Investment Banking functions such as trade lifecycle management, revenue accounting & control, and data management.

Some notable fintech startups in the blockchain space include:

1. FunderBeam which received $2.6 Million in capital from VCs. It is the primary and secondary marketplace for raising capital and securing early stage investments through blockchain.

2. Chromaway: Chromaway offers three products: Postchain (a consortium database for companies to share information between each other), Esplix (It allows participants to verify documents and create process workflow in business using smart contracts and is currently used for land registry and other usecases) and Token (It allows money transfer between different bank account which can be from different banks)

3. Tradeblock It is the leading tool set for institutional bitcoin traders, featuring market analytics, blockchain insights, order management, trade execution, team communication, and compliance automation.

Banks expect to use the blockchain technology to lower down the costs by removing the dependency on the middleman, make the transaction process faster and updating the data in real time. Most of the banks are focusing their blockchain technology for improvement in three key areas: consumer lending, retail payments, and real-time information sharing of transactions across business divisions and institutions.

List of Top 10 Banks Using Blockchain:

- HSBC

HSBC Holdings PLC is a British multinational banking and financial services with company headquartered located in London, United Kingdom. It is the world’s sixth largest bank by total assets and the largest in Europe with total assets of US$2.374 trillion (as of Dec 2016).

- Santander

Santander UK plc is a British bank, owned by the Spanish Santander Group. It is one of the UK’s leading personal financial services companies and one of the largest providers of mortgages and savings in the UK. The bank has around 20,000 employees, 14 million active customers, with almost 1,010 branches and 50 corporate business centers across the globe.

- Barclays

Barclays is a British multinational banking and financial services company with its headquartered located in London, UK. It is a universal bank with operations in retail, wholesale and investment banking, as well as wealth management, mortgage lending and credit cards. It has operations in over 50 countries and territories and has around 48 million customers.

- Bank of America

Popularly known as BofA, Bank of America is a multinational banking and financial services corporation headquartered in Charlotte, North Carolina. It is currently the 2nd largest bank in the United States by assets. By the end of 2016, BofA was the 26th largest company in the United States by total revenue. It was also ranked #11 on the Forbes Magazine Global 2000 list of largest companies in the world.

- Commonwealth Bank

The Commonwealth Bank of Australia is an Australian multinational bank with businesses across New Zealand, Fiji, Asia, USA and the United Kingdom. It is commonly referred to as the Commonwealth Bank or CBA or Commbank. The Commonwealth bank provides a variety of financial services including retail, business and institutional banking, funds management, superannuation, insurance, investment and broking services. It is the largest Australian listed company on the Australian Securities Exchange as of August 2015 with brands including Bankwest, Colonial First State Investments Limited, ASB Bank (New Zealand), Commonwealth Securities Limited (CommSec) and Commonwealth Insurance Limited. Also, Commonwealth Bank is the largest bank in the Southern Hemisphere.

- State Street Corporation

State Street Corporation, also known as State Street, is an American worldwide financial services holding company. It was founded in 1792 and is the second oldest financial institution in the United States of America. The company is headquartered in One Lincoln Street in Boston and it has offices in 29 countries around the world.

- USB

United Bank of Switzerland, UBS is a Swiss global financial services company, incorporated in the Canton of Zurich and co-headquartered in Zürich and Basel. The company provides wealth management, asset management, and investment banking services for private, corporate and institutional clients worldwide. Its assets under management (AuM) amounted in 2014 to US$1,966.9 billion, representing a 15.4% increase in AuM compared to the equivalent data of 2013. It is the biggest bank in Switzerland, operating in more than 50 countries with about 60,000 employees around the world, as of 2014.

- Goldman Sachs

The Goldman Sachs Group Inc. is an American multinational finance company that engages in global investment banking, investment management, securities, and other financial services including asset management, mergers and acquisitions advice, prime brokerage, and securities underwriting services. It also sponsors private equity funds, is a market maker, and is a primary dealer in the United States Treasury security market. Goldman Sachs also owns GS Bank USA, a direct bank.

- Deutsche Bank

Deutsche Bank AG is a German global banking and financial services company with its headquarters in the Deutsche Bank Twin Towers in Frankfurt. It has more than 100,000 employees in over 70 countries, and has a large presence in Europe, the Americas, Asia-Pacific and the emerging markets. In 2009, Deutsche Bank was the largest foreign exchange dealer in the world with a market share of 21 percent. The company was a component of the STOXX Europe 50 stock market index until being replaced on that index on August 8, 2016.

- Société Générale

Société Générale is a French multinational banking and financial services company headquartered in Paris. The company is a universal bank and has divisions supporting French Networks, Global Transaction Banking, International Retail Banking, Financial services, Corporate and Investment Banking, Private Banking, Asset Management and Securities Services.