Banking landscape has been changing drastically with innovative technology making its way in. From huge piles of papers and stacks of registers, now the banking industry has become a world of computers and networks. Banking technology has gifted us advanced safety features such as biometric scanning. Moreover, it has also replaced cash in our wallets.

No doubt, both banking and technology has taken a huge leap in the past few years. However, unbelievably this is just the beginning. Like the ocean, a large portion of the technological ocean remains unexplored. These unexplored horizons of technology promise a better, more secure and more efficient banking system in the future.

Below are the 3 top-notch technologies with potential to transform the banking system:

Blockchain Technology:

The backbone to next-gen currencies like Bitcoin, Blockchain is set to disrupt the financial and banking systems. It is a distributed ledger. This means the ledger is spread across a network of peers or participants.

The technology has given a new shape to the banking sector. It has made the banking sector safer than ever before. Moreover, after complete adoption of blockchain, banks have an opportunity to generate more revenue and save operation charges. Soon, banks will curate customized and secure services with the help of blockchain.

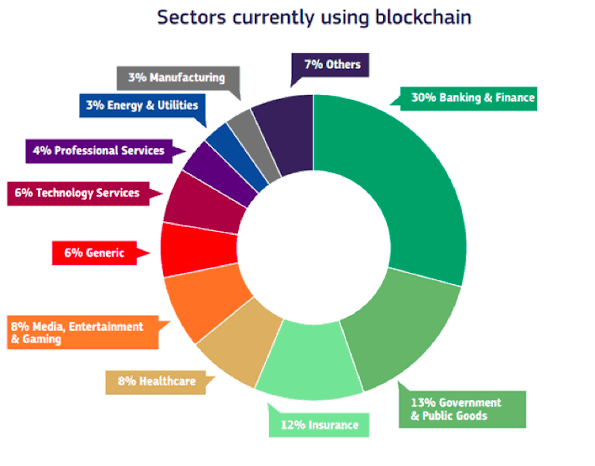

Considering the endless perks offered by blockchain technology, banking and finance sector has adopted the technology to a large extent. The pie-chart below indicates the rising adoption of blockchain technology in the world of banking and finance.

Intellectsoft: Intellectsoft has served its well-known clients with IT solutions since 2007. It is a popular software development company dealing with emerging technologies like Blockchain, Artificial Intelligence and Big Data. The firm has well-qualified team to deal with blockchain. This team has provided a number of solutions to startups ranging from product design workshops to distributed applications and smart contracts. Apart from startups, the company also provides solutions like consortium networks, public blockchain networks integration and consulting to enterprises.

Artificial Intelligence:

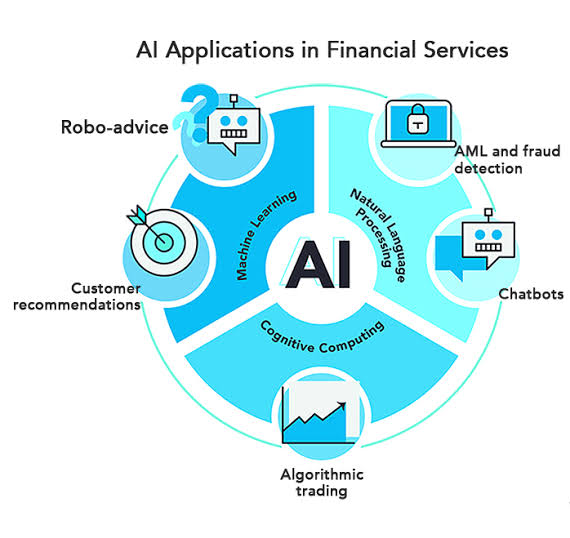

Artificial Intelligence is an emerging branch of computer science aiming towards creating intelligent machines which would work like humans. AI allows machines to learn from experience like human brain. Today, it is one of the major aspects in digitalization of the banking industry. Always-on chatbots, predictive analytics and voice recognition are a few products of AI that are rapidly being used in banking and finance. The infographic below shows various AI services being utilized in banking.

However, AI hold potential to offer a wider range of services and products to the banking sector. In future, it will have the ability to detect and combat fraud transactions within minutes.

Chatfuel: One of the leading chatbot platforms, Chatfuel has helped several firms increase sales, reduce costs and automate support on Facebook. The company offers an intuitive visual interface that allows businesses with non-technical background to design and build chatbo flows. The developers also get the added benefits of an easily-editable front-end. Chatfuel’s clients range from small and medium companies to large players like Adidas, T-Mobile, LEGO, TechCrunch and many more.

API:

Application Programming Interface is an intermediary software which allows two applications to communicate with each other. When applied in the banking world, a new term is evolved called ‘open banking’. Open banking is a system that gives user a network of financial institutions’ data by utilizing API.

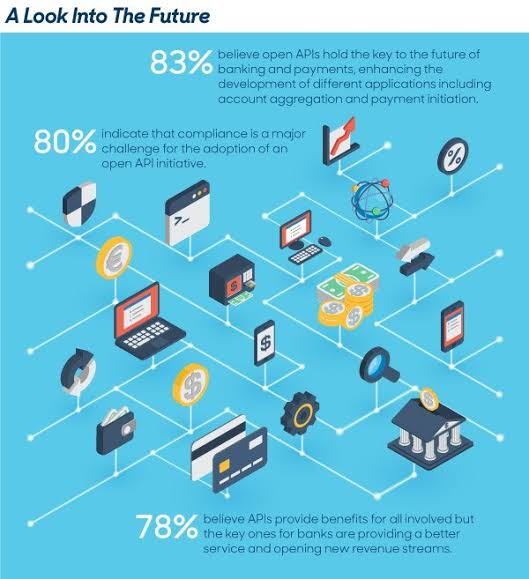

API will allow banks to supply enhanced and data-driven services at a quicker pace. It will also allow the banks to act as a third-party service provider. Banks would be able to provide products and services with integrated information from different sources. No wonder, as depicted below, 83% of EDC survey respondents have faith in API for their future. Although, complete adoption of API in banking might take time, but according to surveys and stats it is inevitable.

TrueLayer: A young company powered by inspired and dedicated workers offers several API solutions. The firm makes it easy for fintech and other related companies like retailers to access bank APIs. This allows them to board the train of open banking and Payment Services Directive 2 easily.

Overall, over a period of time with technology, consumer behavior has also changed. In the coming time, a wide range of remote technologies will allow you to interact with your bank more conveniently and efficiently. From robots greeting you at the door of your branch to waving your hand for payment, technology will continue to alter the banking world towards betterment.