Nowadays generating insights from data is not a choice but a business differentiator for companies. Most banks face big data, which is large and impossible to process using standard software and tools. Banks which are futuristic will utilize the opportunity to crunch unstructured data and increase value delivered to customers.

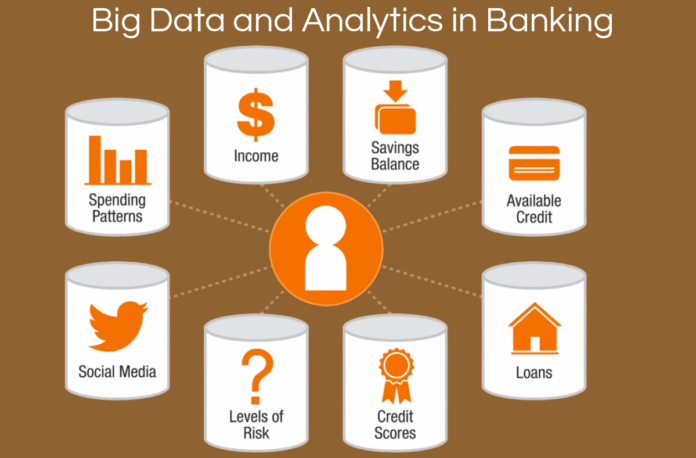

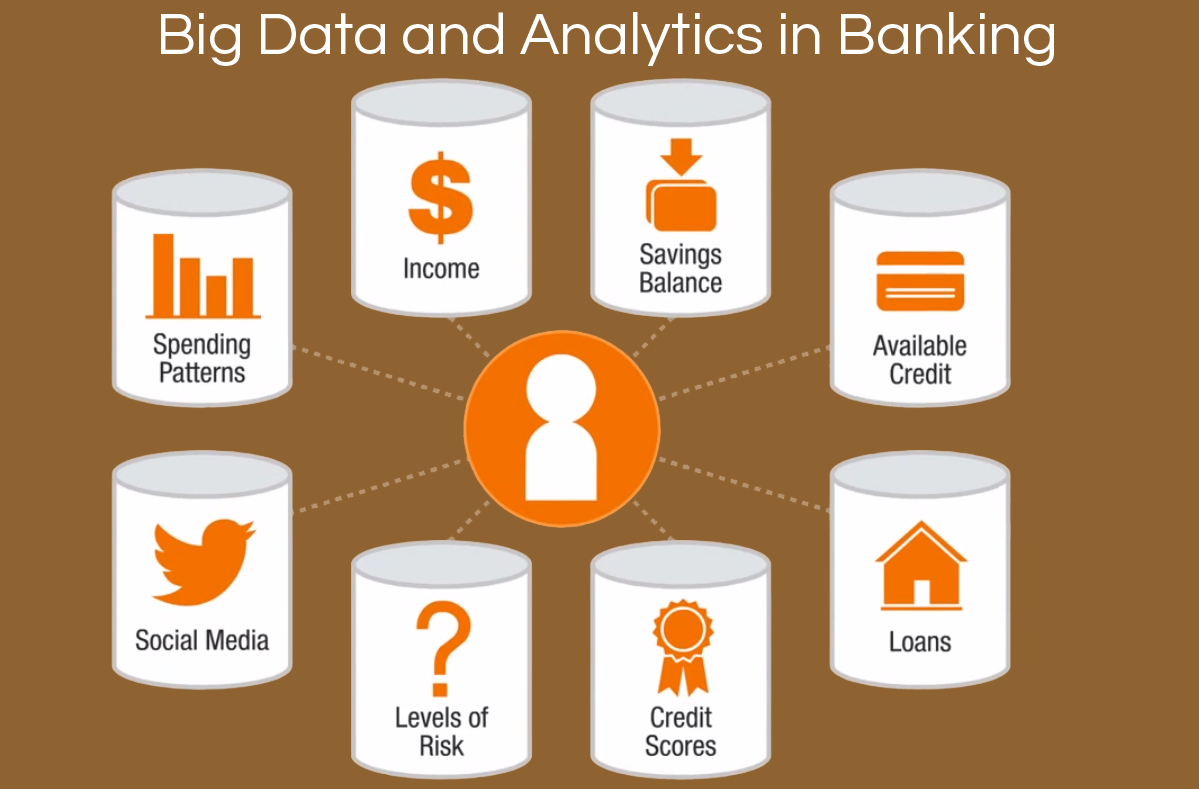

90% of the financial institutions think that big data will make them competitive and will take new initiatives in this direction. Big data in the banking industry represents the highest level of opportunity at this time. There are multiple data sources within the bank such as ATM transactions, credit or debit card transactions, web interactions, call logs, social media and customer’s bank visits. This data needs to be stored, retrieved and analyzed to solve business problems for the bank.

Why data is important for a bank?

Banks interacts with millions of customers for number of products such as credit card, insurance, mortgage, saving account etc. through number of channels including web, mobile and offline channel such as retail, ATM. The data generated during this process is immense and can be used to derive meaningful decision for the bank. Decisions such as what kind of credit card will be suitable for professional office going users. What should be the credit limit on the card? For example, by analyzing behavioural and social media data of the target users, the bank can know whether the newly launched credit card has the features which will be popular among the users.

What are the areas in the bank where analytics can be applied?

The concept of analytics is old but it is reborn with new powerful tools that will process the data at much higher speed. Banking industry leads as compared to other industries in using BI tools. Following are the areas in which big data is used:

Credit Card Fraud Analytics:

Today credit card is exposed at multiple locations such as retail shops, petrol pumps and online purchase. Banks and credit card companies have made millions of losses in credit card frauds. The volume and variety of data to be handled by data warehouse has made credit card fraud detection one of the challenges in the industry. The fraud detection needs to be proactive and should be preventive in nature. Big data has solved the problem by increasing the speed of retrieval of data, data storage and detecting fraud in real time.

Risk Management:

Banks need to evaluate the risk of making loans to each customer in retail banking. BI tools can retrieve information from systems to give insights on customer transactions and its interactions to understand how much risk is associated with particular customer. Banks have been able to analyze the geographic areas in which insurance should be offered. Further, banks have analyzed regional economic data and historic changes in the housing prices to know whether low-interest loans should be offered to customers.

Marketing and sales automation:

A large European bank realized that their marketing campaigns were ineffective and it took a long time to evaluate the results of the marketing campaign. Further, it took more time to present these findings to the senior management of the bank. Bank decided to apply analytics by connecting all channels of communication with the customer to a centralized system. Analytics helped by tracking customer data on social media and know what customers want in real time. This information was then used in their marketing campaigns and the results of the marketing campaign were analyzed in real time.

Customer Churn Analysis:

Losing customers is a serious issue for a bank. A mid size US bank was losing customers and the management wanted to identify the customers who are most likely to churn. In this machine learning techniques were used on massive amount of data available on lost customers to identify their behavioural patterns before customers shift to competing bank. Bank successfully applied the model and made personalized offer to customers to reduce the churn.

Regulatory Compliance:

One of the biggest concerns for the bank executives is the regulatory compliance. Banks have to deal with FATCA, FINRA, Dodd-Frank Wall Street Reform and Volcker rule. BI can help banks by pulling data from different systems, analyzing and compiling information in reports addressing regulatory requirements.

Product Design & Pricing:

Banks can collect data on product features, feedback and call centre information to take decisions related to product design. Elasticity modelling for pricing can be measured for products to determine the price-demand relationship. The demand prediction can help banks to determine budget allocation and branch level marketing decisions.

Demand for Analytics skillset:

Today, there is a big shortage of analytics professionals where 83% of organizations are not able to meet their analytics demand. The current ratio of jobs available for senior analytics professionals to qualified professional available for that job is 5:1. There are chief data officers in the organization who collect and store data but there are very few chief analytics officers. Zhongcai Zhang, Chief Analytics Officer at New York Community Bank said that when analytics is done right there will be a healthy equilibrium of supply and demand of analytics in the organization. More business decisions will rely on analytics which will further increase the role of analytics in the organization.

There are many other areas where analytics can be applied such as performance analytics, executive dashboards and operations optimization. The common areas are covered in this article. We will cover challenges faced by banking industry in implementing analytics in next article. Please feel free to leave your comments and we will try to address your queries around analytics tools used in banking industry.